Overview

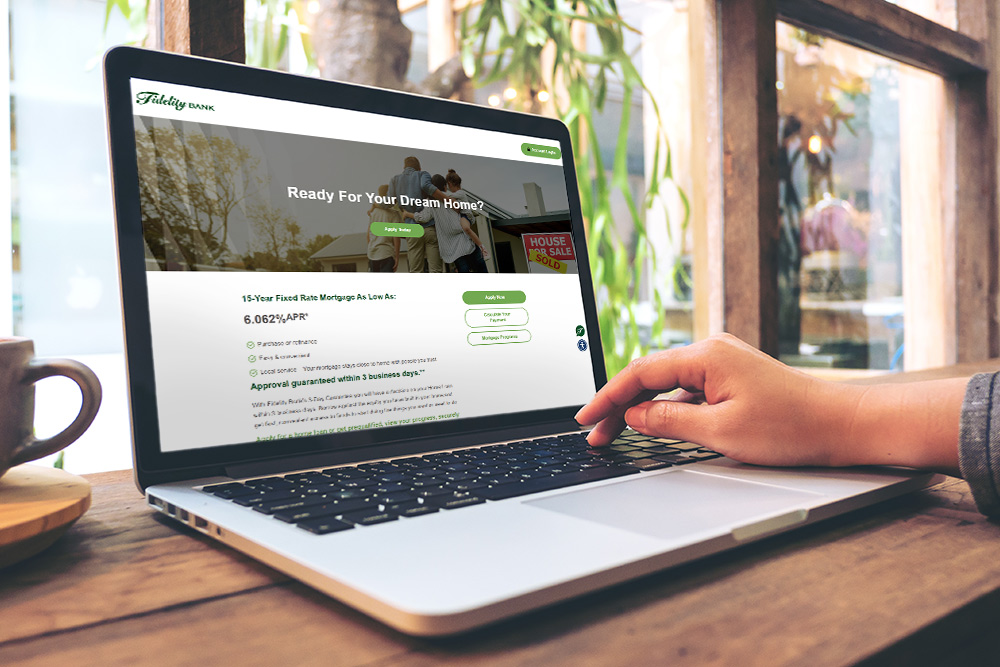

Fidelity Bank found that although their digital campaigns were driving a high-volume of traffic to their website, their mortgage originators were not seeing the same number of valuable submissions as a response. There was clearly a disconnect between clicks on the Apply Now CTA and actual mortgage application submissions. That is when Pannos Marketing stepped in to be their strategic partner and help the bank solve the disconnect.

Let the numbers tell the story:

0.3%

Pre-adjustment mortgage application completion rate

99.7%

Pre-adjustment mortgage application abandonment rate

72.5%

Post analysis and adjustment mortgage completion rate

27.5%

Post analysis and adjustment mortgage abandonment rate

Project Goals:

The Ask:

Fidelity Bank wanted to decrease the overall drop off rate within the application, driving more users to the ‘submit’ page.

The Answer: Pannos worked with the bank to implement cross-domain tracking. We submitted a test application to review the functionality and experience of the application, and from there suggested three main adjustments to the application to help improve the vast drop-off that was happening from page 1 to the submit page.

The Answer: Pannos worked with the bank to implement cross-domain tracking. We submitted a test application to review the functionality and experience of the application, and from there suggested three main adjustments to the application to help improve the vast drop-off that was happening from page 1 to the submit page.

Process

First, we implemented cross-domain tracking focused on pageviews to gauge user progress within the application. Next, we added tags to track scroll data, event interactions, and a cookie preserver to give us a more wholistic view of application performance. Finally, we tested the original application’s functionality and overall experience, and found several issues that were negatively impacting the user journey, including inconsistent question structure and flow and intrusive declaration explanations that were required in order to proceed.

We recommended that the client reorder the flow of questions to keep pages and content intuitively grouped together and remove the required declaration explanations as we saw most of the user drop-offs were happening in this specific section.

The client worked with their mortgage provider to revamp the application - enhancing the overall flow and structure of the application, keeping each section grouped properly to help ease any unnecessary repeated questions and confusion. The client also took our recommendation to remove the requirement of an explanation on certain declarations.

Along will the adjustments within the applications, we added a custom cookie preserver into the application, to place accountability on all various sources that could be driving traffic. The preserver allows us to retain first-part cookie data showing which source and medium users came from, thus allowing us to successfully attribute loan applications to various marketing efforts.

We recommended that the client reorder the flow of questions to keep pages and content intuitively grouped together and remove the required declaration explanations as we saw most of the user drop-offs were happening in this specific section.

The client worked with their mortgage provider to revamp the application - enhancing the overall flow and structure of the application, keeping each section grouped properly to help ease any unnecessary repeated questions and confusion. The client also took our recommendation to remove the requirement of an explanation on certain declarations.

Along will the adjustments within the applications, we added a custom cookie preserver into the application, to place accountability on all various sources that could be driving traffic. The preserver allows us to retain first-part cookie data showing which source and medium users came from, thus allowing us to successfully attribute loan applications to various marketing efforts.

Results

After the aforementioned adjustments were made to the application, the application completion rate increased 24,067% from the original 0.3% to an average of 72.5%. Since the implementation of our cookie tracking code – 18 submissions in October came from paid campaigns, and 14 in September.

Like what you see?

We can do the same for you.